introducing stor-age

Chairman’s letter

This, our second integrated annual report and first for a full 12-month trading period, reflects the company’s continued excellent financial performance since its listing. We achieved this despite a contracting domestic economy.

Stor-Age was the first self storage REIT to list on the JSE or, for that matter, in any emerging market. As a specialist asset class in the early stages of development, self storage offers unique growth prospects which the management team continues harnessing to deliver strong and sustainable growth in returns.

A track record of delivery

Stor-Age has a clear vision and well-articulated strategy that aims to deliver attractive and sustainable investment returns, increase the scale of the business and ensure that the company remains the self storage market leader.

During the year, on all fronts – acquisitions, new store development, existing property expansions and portfolio management – management executed their mandate with discipline and focus and within the scope of the vision and growth strategy.

The executive team has built a track record of delivery since the business’ founding more than 10 years ago. The business model is based on global best practice and strong networks with leading first-world market peers, which is evidenced by more than a decade of successfully acquiring, developing, leasing and operating self storage assets.

timeline

Creating value

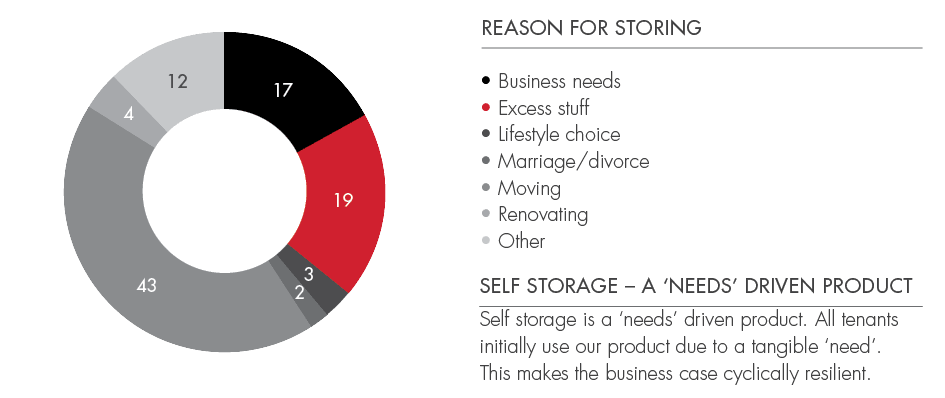

Customer demand and the general economic cycle have low correlation. Residential and commercial customers’ self storage needs are relatively consistent in both strong and weak markets, and Stor-Age has delivered a strong set of results for the year. The 88.05 cents dividend per share for the full year, representing 10% annualised growth from the prior period, came in 3.5% above the listing forecast in the prospectus.

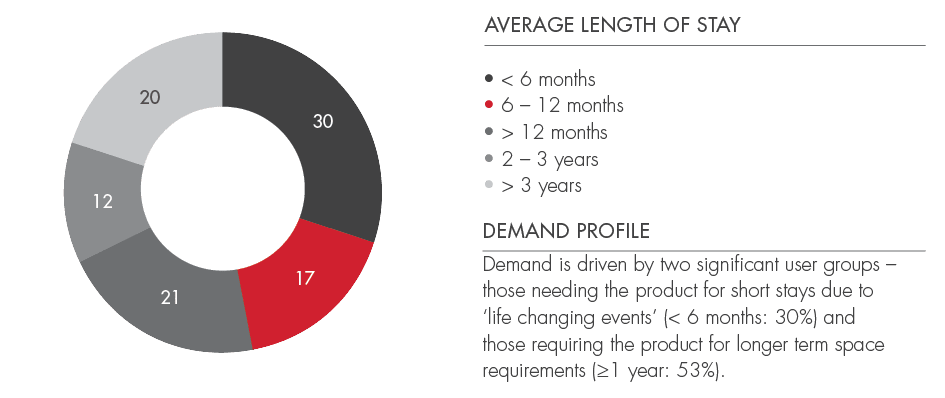

The self storage sector’s resilient investment theme is evidenced by more than 50% of our tenants having stored with us for more than a year as at 31 March 2017. For customers who ended their leases during the year, the average length of stay was 14 months; for existing customers it is 21 months. For properties open more than five years, the average length of stay is 24 months.

Our investment property portfolio grew by R680 million to R2.050 billion, underpinned by a 46 500 m² increase in GLA. The growth in GLA was supported by the key strategic acquisition of Storage RSA (41 800 m² GLA) and the build-out in the existing portfolio by a further 4 700 m² GLA.

Stor‑Age benefits from a conservative balance sheet structure, with bank debt of R253 million in place at year end, with net debt of R244.6 million representing 11.9% of gross property assets. Of this debt, an average of 82% is fixed for a further two‑and‑a‑ half‑year period, and, as debt levels grow with future acquisitions, the company will maintain this conservative hedging profile.

Given the economic environment, maintaining a strong balance sheet remains a key strategic pillar of the business. To this end, in February 2017 we were pleased to raise R400 million of equity capital to fund the Storage RSA acquisition and reduce associated debt.

Global markets

Self storage has an established track record in certain first-world markets, particularly in the US, but there are other developed countries where the industry is less mature. As management seeks to grow the fund, its opportunities are not limited to South Africa or even emerging markets. The same social and built-environment trends that are propelling self storage in South Africa are also at play in the UK, Europe and Australia, and the board continues encouraging management to deepen its networks in these markets where many of the self storage businesses are still privately owned.

Outlook and thanks

I’d like to congratulate the management team and senior employees on successful results for the company’s first full 12‑month reporting period. Management has built a high-quality business with an excellent portfolio, a robust and sophisticated operational platform and a pipeline of exciting acquisition opportunities.

Thanks also to my fellow non-executive directors for their invaluable contributions. Each of them continues to bring their formidable experience to bear on the strategic direction and governance of the company.

Stor-Age has had an excellent second financial year, and the board remains committed to growing the company in a sustainable manner and delivering value to shareholders.

Paul Theodosiou

Chairman

13 June 2017